Trends: Financial Services

Weekly Recap – August 26, 2016

Maybe it’s the convenience. Could be the added security. Perhaps points play a role. Consumers are ditching greenbacks in favor of swipe or tap. Speaking of tapping, Millennials aren’t the only app-ha … Read more

Marketing Statement – July 2016

You can take the consumer out of the Great Recession, but you can’t take the Great Recession out of the consumer. What does mean for your financial brand? It’s time to get creative. Like doling out in … Read more

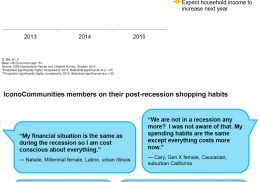

Discounts and deals: 3 things to know about the recessionary mindset.

“There’s a coupon for that.” Not only does this phrase seem to permeate conversation when talking about upcoming purchases, but it has turned into a financial mindset. Consumers may be out of the Grea … Read more

Marathoning for an insurance discount.

Nonsmokers and seat-belt wearers can get a break on insurance. So can people with healthy BMI, blood pressure and cholesterol levels. So, why not go deeper and reward consumers for the tactics they us … Read more

Millennials and eldercare: 4 things to know about the future of caregivers.

What do you think of when you hear the word “Millennial?” While some believe this cohort is “carefree,” “entitled” or “selfish,” some are shaking this notion altogether when it comes to this cohort’s … Read more

Marketing Statement – March 2016

Cash is so yesterday’s currency. Gen We is trending toward mobile payment and PayPal is giddy. Like a fox. They want this consumer relationship to last a lifetime, so PayPal has launched buy now, pay … Read more

Moneyed Millennials mix traditional and alternative banking.

Prepaid cards aren’t only for the unbanked and underserved. Millennial “power users” like to include general purpose reloadable (GPR) cards in their mix of traditional payment options, according to a … Read more

5 reasons why consumers use financial mobile apps.

Need to make a car payment? There’s an app for that. Need to monitor your credit score? There’s an app for that. Need to file an insurance claim? There’s even an app for that. Need to know why c … Read more

9 financial mobile apps consumers love.

Budgeting can be hard. From recording receipts to monitoring bank accounts and making payments, keeping track of finances is hefty work. Maybe that’s why Americans aren’t so great at it. Budgeting is … Read more

What marketers need to know about Millennials and their money.

It’s no secret that marketers want to tap into the $1.99 trillion spending power that the Millennial audience yields. Yet, it’s not all big spending for this cohort, which makes it difficult for marke … Read more