It’s no secret that marketers want to tap into the $1.99 trillion spending power that the Millennial audience yields. Yet, it’s not all big spending for this cohort, which makes it difficult for marketers.

According to CEB Iconoculture research, when it comes to money, Millennials value success, growth and comfort. However, success doesn’t necessarily mean material wealth for this audience, but is rather defined by personal satisfaction.

Money is not going to rule this generation’s life. So how exactly does this audience handle their assets?

Here are a few things you need to know about Millennials and money:

Millennials are on a budget.

According to News America’s report Millennials and Student Debt, the average college graduate with a bachelor’s degree owes almost $30,000 in student loans. Knowing this, Millennials are looking for ways to keep spending low as they work to pay off their debt. Compared to other cohorts, 67 percent of Millennials stick to a budget. Big purchases like buying a home are being put off. In their most recent report, the National Association of Realtors found that the median age for a Millennial buying a home is 29 years old. In order to bridge the gap and prepare for this milestone purchase, more and more Millennials are living at home after graduation. According to Pew Research Center, 26 percent of Millennials lived with their parents in 2015.

Millennials are also keeping tight control of spending through mobile apps and couponing. In its recent Coupon Intelligence Report Valassis found that Millennials are increasingly becoming thriftier:

- Eighty-nine percent of Millennial parents use coupons when shopping, compared to 78 percent of Millennials without children.

- Millennials with children are more likely to have increased their use of a smartphone to keep a shopping list (48 percent); get coupons or deals (53 percent); and download retailer loyalty offers (52 percent).

One of the most widely downloaded finance apps is Intuit’s Mint. Like a fitness app, Mint tracks spending and alerts users when they flirt with budget limits. Another popular finance app is Wally. This expense tracking app allows users to scan receipts and categorizes purchases. Heard of Venmo? Millennials have. This app combines finance tracking with social media. Users can send payments with just a few swipes on their smartphone, making paying friends back or helping them with their finances easy.

Millennials are a skeptical audience.

Although this audience uses mobile apps to track finances, Millennials are skeptical when it comes to how their money is managed. Millennials have witnessed several fiscal fiascos with the Great Recession of 2007, Europe’s credit emergencies and the Bernie Madoff scandal, so it’s no surprise that they are very skeptical of the finance industry. When it comes to outsider’s opinions, Millennials will consider advice and recommendations; however they want to see the facts – ideally, the math.

Millennials are even skeptical of Social Security benefits. Four out of five Millennials (81 percent) are concerned that Social Security will have been bankrupt when they are ready to retire.

Millennials think ahead, way ahead.

Yes, Millennials are already saving and investing for their future and retirement. The Transamerica Center for Retirement Studies surveyed more than 1,000 currently employed Millennials and found that a majority are big savers. Take a look:

- Seventy percent of Millennials are already saving for retirement and started saving at age 22 (median).

- Three out of four say that retirement benefits offered by a prospective employer will be a major factor in their decision on whether to accept a future job offer.

- Seventy-one percent of Millennials participating in a 401(k) or similar plan find mobile apps for managing retirement accounts to be helpful.

Let’s recap.

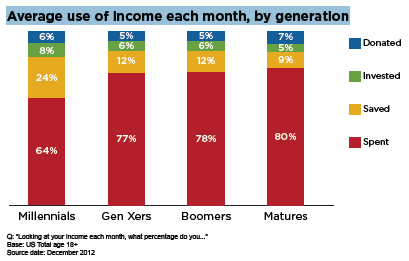

Yes, this generation has the spending power of $1.99 trillion, but that doesn’t necessarily mean they are spending it all. Millennials are a generation that invests for the future, keeps spending low, saves more and even donates. Although skeptical of financial advisors due to the corruption of previous years and experiences, this generation takes their finances very seriously. This generation saves, donates and invests more than generations prior. See the chart below for more details.

Source: CEB Iconoculture

As a marketer, how can you engage with this generation? It’s simple. Earn their trust. Once their trust is earned, invest in how this audience values success, how they spend their money and how they save for their future. If you invest a little in them, they just may invest with you.