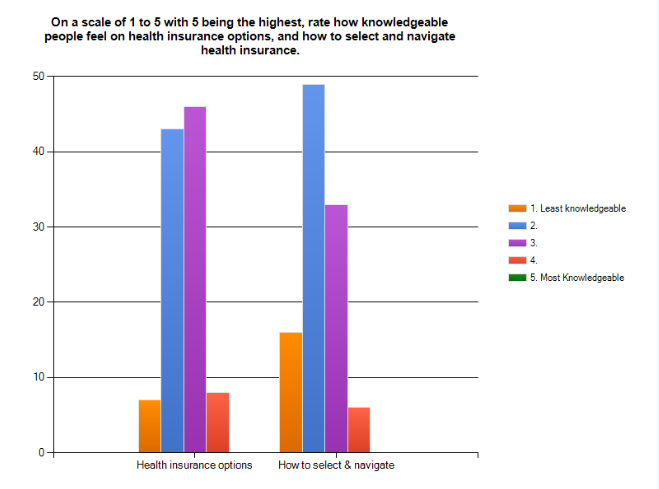

Our second Brogan talks to women survey went out last month and we asked our female respondents about the health insurance marketplace. With the deadline to sign up for health insurance being March 31st 2014, there is a sense of urgency to make sure that everyone is covered by some form of health insurance. However, one of the most common barriers to choosing a plan happens to be the confusion surrounding the process of selecting a plan. Our survey found on a scale of 1-5 (1 being least knowledgeable and 5 being the most knowledgeable) that 47.1% of our respondents rated themselves as a 2 on being knowledgeable about how to select and navigate health insurance options.

Now, this issue does not just exist in our survey population. Rather, this is an incredibly common theme and a true barrier to getting individuals to sign up for health care.

Interestingly enough, consumers have reason to be confused. According to the Washington Post, since the inception of the law in April 2010 there have been roughly two dozen changes to the Affordable Care Act. Some of these changes are minor, while others extended deadlines for employer groups and private individuals. All of these changes have just complicated the issue more.

Bottomline, what can be done to help consumers?

Well, there have been attempts to simplify the process by streamlining the healthcare.gov website, but that may not be enough. Consumers need to have an advocate and a resource to understand the cost/benefit to each plan. Perhaps health insurance companies can offer free assistance without the pressure to buy their plan or independent agents should step up to provide 3rd party consulting.

The insurance landscape is a complex one to say the least. But, when it comes to health, consumers do need help. And without that help, they will remain in a certain limbo of balancing costs and benefits to each plan without knowing if they are getting the best bang for their buck.